Fund Management Operations

Investment Philosophy

As investment professionals conscious of sustainability, we are committed to provide the “best in quality” performance over the medium and long term.

In order to achieve this, we shall strive to provide stable returns by actively incorporating new investment methodologies and by responding to ever changing market environments.

Regarding active investments, we shall specify existing market inefficiencies and turn them into investment opportunities through establishing disciplined investment approaches to capture excess returns.

In order to achieve this we shall execute the following.

- Conduct thorough & proprietary research on a global basis to reveal inefficiencies.

- Take appropriate risks driven by professional judgments and based on risk tolerance levels.

- Manage risks from multidimensional perspectives.

- Control and improve product quality on an ongoing basis for all investment processes.

Investment Research Platform

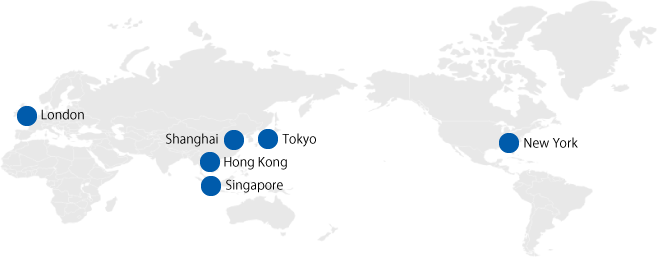

With more than 250 investment professionals in Japan and overseas, we have a global investment research platform in place to meet the diverse asset management needs of our clients.

Investment Professionals

260

Average Years of Industry Experience

15.4

CFAs ・ CIIAs (note)

94

| note: | "CFAs" stands for Chartered Financial Analysts and "CIIAs" stands for Certified International Investment Analysts. |

|---|---|

| * | As of October 1, 2023. |

Assets under Management

| Institutional Accounts | USD 64 billions | |||

|---|---|---|---|---|

| Domestic | USD 54 billions | |||

| Discretionary Accounts (Pension Funds) |

USD 30 billions | |||

| Discretionary Accounts (Others) |

USD 5 billions | |||

| Investment Advisory Accounts | USD 19 billions | |||

| Overseas | USD 10 billions | |||

| Investment Trusts | USD 78 billions | |

|---|---|---|

| Publicly Offered Funds | USD 51 billions | |

| Privately Placed Funds | USD 27 billions | |

| * | AUM is as of September 30, 2023. |

|---|

| * | Figures shown in US dollars are conversions from Japanese yen based amounts, at USD/JPY 149.225. |

|---|